My Takeaways From Baby Steps Millionaire

Money. The mere mention of the word can evoke all kinds of thoughts and emotions. From joy to concern to comfort to panic to, oh crap, did I pay the electric bill this month?

Most all of us have money in some way, shape or form and the opportunity to do most all we want with it. But could you be a millionaire? I am sure some reading this are, some don’t care, some see no way and maybe some have no idea if they are or not. From game shows to lottery tickets to Austin Powers movies, the milestone of being a millionaire has been one known throughout the world.

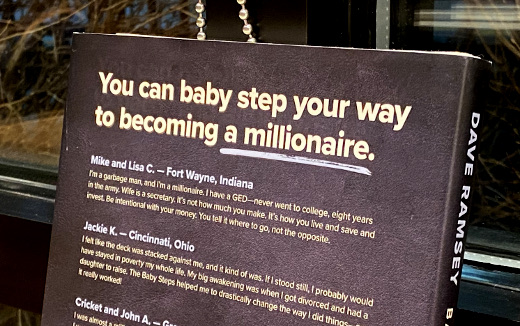

But back to the question – could you be a millionaire? Dave Ramsey thinks you can. The long-time radio and TV host of personal finance programming and author has been professing common sense regarding money and finance for decades. Where I have been aware of him and seen and heard his shows on occasion, I have never really dove into what he professes. When I heard of his recent book Baby Steps Millionaire, I was intrigued and picked up a copy.

Baby Steps Millionaire tells the tales of people who became millionaires – they have a net worth of or over one million US dollars and how they achieved it. As I read through the book, a few takeaways formed in my mind.

People and how they did it – Where I am not trying to spoil the book for you if you are equally intrigued to read it, it may not come as a surprise for the majority of them there was no “fast path” and it involved sound spending and investing over time. There are many stories that are somewhat similar in context in how people reigned in spending, cut expenses and made lifestyle choices and saved even when they didn’t think they could. These stories make up the first half of the book, and though after a while they become a little repetitive, Ramsey is merely driving home the point on how you can be a millionaire too.

Survey says – The second half of this book is the results of a survey of millionaires, and builds and heightens the first half with more concrete data. It starts out going into rather detail about how the survey was developed and conducted (maybe all surveys do this, I don’t read many surveys in this kind of detail) and then shows the results of what millionaires say about how they got to where they are. Sure, a few inherited their millions from the infamous long-lost uncle, but many followed the sound money steps that were driven home in the first part of the book to get to where they are.

Off-site storage – Dave Ramsey’s first baby step to financial stability is one I have known for years in setting up an emergency fund with $1,000. If you get into a bind, it’s the thing you break the figurative glass of and tap into, then work to replenish it. Though we have savings accounts of different ilk, my family did not have a specific emergency fund, and now we do. But $1,000? Today?! A small amount comes out of each of my wife and I’s paychecks and goes into the account that is at a bank that isn’t our primary and one we have to make an effort to get to. It’s a good feeling to finally have this.

Baby Steps Millionaire is a good read that I recommend as a friendly reminder of how you can achieve financial goals, whether you want to be a millionaire or not. Where some of it can be repetitive, it is a positive book that shows many examples of how people got onto a financial track and took off. As I give away all books I read, I am giving this one to someone who is getting back on track in many ways, and I hope it gives them inspiration when it comes to the M word.

This is from The Hot Iron, a journal on business and technology by Mike Maddaloni.

Did you enjoy this? Subscribe to The Hot Iron by RSS/XML feed or Read by Email

Book Take-Aways • (0) Comments • Permalink